ources:

UPDATED “Letter to Lawmakers” –author: //Gordon Wayne Watts// DATE: Tue., 11 Jan. 2022

*** Say this: “Dear Congressman / Congresswoman ( ___ name ___ ) :

Please introduce a House companion bill for S.2598 (Fresh Start Student Loan Bankruptcy bill), and please co-sponsor H.R.4907 (Private Student Loan Bankruptcy bill).”

*** Say this: “Dear SENATOR MARCO RUBIO (and: SENATOR RICK SCOTT) :

Please co-sponsor S.2598 (Fresh Start Student Loan Bankruptcy bill), and please introduce a Senate companion bill for H.R.4907 (Private Student Loan Bankruptcy bill).”

“Bullet Point Summary” of Talking points ( Pick a few points – and MAKE THE CALL!! )

1 – Student Loan Bankruptcy is our “Conservative alternative” to Liberal Free Handouts.

2 – S.2598 has twice as many GOP sponsors as Democrat: It is NOT a “liberal” bill –or a free handout. Please join Conservative Republicans, Sen. Josh Hawley (R-MO) and John Cornyn (R-TX) on this bill! PROOF: https://www.Congress.gov/bill/117th-congress/senate-bill/2598/cosponsors

SEE ALSO: https://www.Congress.gov/bill/117th-congress/house-bill/4907/text

3 – Only with the “threat of bankruptcy” to push back Higher Ed swamp lobbyists and Dept of Ed “bullying” will other needed actions get done (“Conservative” plans to cut taxpayer-funded college loan subsidies aka “pork spending” bailouts{{7}} for the higher ed swamp, and “Liberal” plans to make PSLF – Public Service Loan Forgiveness – work well.)

4 – PROOF that #3, above, is correct: Ask why Rick Scott or other “conservatives” haven't even TRIED to cut these Liberal pork bailouts{{7}}, & ask why PSLF has 98-99% fail/reject rate!{{17}}

5 – If we don't cut this pork spending, we'll continue to hemorrhage & bleed to death roughly THREE HUNDRED MILLION ($300,000,000.oo) per DAY in unneeded taxpayer-funded student loan subsidies{{18}}, thereby crashing the dollar{{25}}, collapsing our economy if left unchecked.

6 – America is headed for a crash of the dollar, no matter what, but if we act (see 3—5, above), we might slow it down 1 or 2 more generations—that is, save our children & grandchildren.{{25}}

7 – College loan borrowers have MORE than repaid their loans back to taxpayers{{14}}, and this was even at illegally-inflated price-gouging levels!{{3}}

8 – College was free (or at least affordable) in our youth, but NOT affordable, now!{{3}}

9 – If Credit Card users, Business owners, Donald Trump, GAMBLERS, & even “fly by night” scam colleges –that rip off students (& then go out of business) can have bankruptcy defense, why can't college students who're just trying to better themselves? <<Immoral double standard

10 – Number 9, above, is not only a double standard, it also violates JESUS' golden rule—binding upon all politicians claiming to be Christian! (“Bankruptcy for me, but not for thee, oh ye students.”)

11 – Bankruptcy is “Economic 2ND Amendment,” a means of self-defense, a “Free Market” check on excessive lending—just like real 2ND Amendment—makes economic violence go DOWN, not up.

12 – ***MANY AMERICANS HURT!!!*** With over 45 Million Americans holding student debt & another 40—50M cosigners & family, over 100M+ total{{11}}, it's no wonder Georgia senate seats “went blue” (GOP lost House to Pelosi several elections in a row) after GOP lawmakers kept defending “bankruptcy for me, but not for thee” immoral double standard—angering student voters!

13 – ***OLDER AMERICANS HURT MORE!!!*** STUDENT DEBT is not a "young person's problem," but rather an "older person's problem": Older people outnumber younger people with student loans, and they owe far more.{{21}}

14 – BLACK Americans hurt at disproportionately high rates!{{22}}

15 – Polls{{24}} – MOST Americans{{9}} do SUPPORT return of bankruptcy protections!!

16 – Bankruptcy Uniformity (a special type of Equal Protection) is not a “free handout,” but rather required by the U.S. Constitution's Uniformity Clause—look it up: ARTICLE I, Section 8, clause 4, U.S. Constitution. This is not in the “amendments,” but rather the original Constitution itself!

17 – Removal of Bankruptcy terms from existing loan contracts illegally changed the contracts!{{12}} So, those wagging their fingers & saying “students knew what they were signing up for” are wrong!

18 – Even BEFORE the pandemic, over 50% of ALL student loan borrowers weren't paying down their loans{{16}}, so you can only imagine the train wreck coming this February when the “pause” expires: We must act NOW to put a stop to this disaster: See 3—6, above.

19 – Even the infamous 2008 Housing bubble only saw somewhere from 17% to 26% default rate{19}}, but—by contrast—the current Higher Ed bubble has closer to an 80% or 85% default rate.{{20}} Thus, this is NOT a “bad borrower” problem, but rather a “bad lending system.” LENDING SYSTEMS FAIL—and so do whole countries and economies!

20 – Free College? Given the above, it would cost taxpayers untold trillions LESS to “direct fund” higher ed (like we do with public ed—a system that isn't an economic train wreck on taxpayers!).

21 – Or: We should get the Federal Gov't OUT of higher ed funding: Government screws up anything it touches: American Higher Ed is an “epic fail” lending system that must be abolished, lest it take down the entire country—but only with the “threat” of bankruptcy can needed subsidy cuts be had.

22 – NINETEEN (19) STATES have higher FEDERAL Student-Loan DEBT THAN THEIR ANNUAL STATE BUDGETS—obscenely oppressive “over-reach” of Federal Government!{{23}}

23 – Removal of bankruptcy wasn't justified by bankruptcy abuse: Back when student loans were treated like all other loans in bankruptcy court, only about zero-point-three (0.3%) percent were discharged in bankruptcy. But removal of bankruptcy defense has allowed mayhem to ensue!{{26}}

THEREFORE: Please pass both bankruptcy bills (S.2598 & H.R.4907) into law, & then, with the “threat of bankruptcy” to make higher ed swamp back off, get Liberal pork student loan bailout subsidies / spending GONE, & enact “Conservative” Rule of Law price controls in higher ed!!

If that looks daunting, just pick a few favourite points above & MAKE THE CALL—& repeat til it's passed.

[[ LONG VERSION ]] > Dear Congressman Franklin (or Steube – or Bilirakis – or Senator Rubio or Rick Scott)

I elected you to be a conservative, and while I appreciate your apparent motives/plans, you're falling woefully short in key areas that threaten the very fabric of our nation, so I'm asking you to pay close attention—as our economy may not get another “2ND chance”: As documented by numerous sources on both sides of the political isle, outstanding student debt was only{{1}} about $300 Billion (0.3 trillion) in 2004, but now, it stands at about Two Trillion dollars{{2}}. This threatens taxpayers who own almost all student debt.{{14}} Moreover, college was either free or VERY close to it{{3}} just decades ago, according to sources on both sides of the political isle—and this threatens our children & grandchildren too, since they can't afford an education as their parents & grandparents were able to have. (I add: College was optional back then, as you could get a “career job” with only high school diplomas, but now college is needed in our age of technology.) As a Conservative, you know that tuition rose because we used tax dollars to make or guarantee college loans: Colleges blithely raised tuition to match increased funding availability, so the first thing we need to do is cut subsidies as Rick Scott has promised to do.{{4}} I'm not a “free handout liberal” and do NOT ask for free college or loan “forgiveness,” but as even Rick Scott{{5}} and local Conservative Journalist, Gordon Wayne Watts{{6}}, both rightly label tuition as a tax, we ask you to immediately reduce (or, if possible, ELIMINATE) all use of MY tax dollars to make or back toxic collegiate loans to students who will NEVER be able to pay these illegally-inflated costs when they were just trying to do like past generations and better themselves. (EDITOR'S NOTE: While I'm a far-right Conservative and really oppose ANY free handouts, I do note that IF we did “free college,” like we do free “public ed,” it would not only cost students less—it would also cost taxpayers less, as price controls and subsidy cuts would reign in costs, so if “free” college is actually less expensive—making colleges live within their budgets, then more moderate measures are even more justified.) While there is no bill number for the needed subsidy cuts (because no lawmakers have had the guts to file such a bill), Mr. Watts has kindly provided a copy of a proposed bill that would effect the needed subsidy cuts—on the last 2 pages of the written testimony he submitted to the Senate Judiciary Committee recently.{{7}} Lastly, all you GOP lawmakers who keep claiming to be “conservative” and “for” subsidy cuts (getting MY tax dollars OUT of making/backing toxic and illegally-price-gouged student loans) have NOT even TRIED to introduce a bill to reduce or eliminate these UNNEEDED subsidies (we never needed them in the past for colleges—and DON'T need them now with public ed, hello!?), and we must ask “why?” ANSWER: It is now clear: Only with the “threat of bankruptcy” returned to students loans (like it was in the past—back when the system worked) will the rogue dept of ed & lawmakers pressured by lobbyists behave & finally reduce/eliminate these UNNEEDED subsidies and/or introduce “price controls” (like we do with other “legal” monopolies & utilities: Electric, Internet, Water, Insurance, etc.) If you “disagree,” then please “explain me” why you haven't even TRIED to do what y'all have been promising for years (decades) re subsidy cuts. If you agree, then please speedily get behind these 2 bills (below). Ending this Ponzi scam failed lending system is the goal, but in the meantime...

(a) S.2598, the “Fresh Start” student loan bankruptcy bill: https://www.congress.gov/bill/117th-congress/senate-bill/2598/cosponsors And: (b) H.R.4907, a similar bill addressing private college loans: https://www.congress.gov/bill/117th-congress/house-bill/4907/text Let me be clear: Bankruptcy uniformity is NOT a free handout, but rather REQUIRED by The U.S. Constitution's uniformity clause (Art.I, Sec.8, cl.4: Google it if you slept in law class that semester!), as well the Jesus's “golden rule,” something all my “double standard” GOP lawmaker, who claim to be Christians, are NOT obeying!! (GOP lawmakers tell students: “Constitutional Bankruptcy uniformity rights for Credit Card users, for Trump –even for GAMBLERS, and for ME, but not for THEE,” and wonder why we keep losing elections—like we did in Georgia, recently!?) Let me be clear: Only with the “threat of bankruptcy” will there be necessary Free Market forces to “tamp down” excessive Liberal pork spending higher ed Liberal bailouts with MY tax dollars—and without it, we will continue to hemorrhage our tax dollars: College debt, at about $2 Trillion, is almost TEN percent of total U.S. Debt.{{15}} This bill, S.2598, as of press time, has twice as many GOP sponsors as Democrat, and is our Conservative alternative to free handouts, etc. As Josh Hawley, a very conservative Republican, said in a recent committee hearing, while he didn't support “cancellation,” he couldn't think of many good reasons to keep student debtors as “lifelong serfs” to banks & universities.{{8}} LAWMAKERS, immediately support S.2598 and H.R.4907, and then—with needed “Free Market” forces to back off swamp lobbyists, enact needed pork spending cuts{{7}} in higher ed AND implement needed price-controls—like we do with everything else. Do this, or else we WILL crash the dollar from obscene excessive spending, and I will hold YOU responsibly in the voting booth and in the free press reporting of same. If GOP lawmakers don't act NOW, they're denying their kids/grandkids the same “fair chance” for education, and thus hate their children, grandchildren in this regard – and hate all Americans as evidenced by their willful refusal to act to avert a crash of the dollar & collapse of the economy. By the way, telling students to repay something they've already paid-back several times over{{14}} and which most aren't paying on anyway{{16}} is not the solution: They've already done “more than” their fair share, and asking anything else will kill the mule. ** BONUS – INFORMATION: ** First, there is a LOOONG list of supporters from numerous powerful republicans AND powerful democrats who agree with the need for student loan bankruptcy defense.{{9}}

** POLLS: Secondly, most Americans agree with the need to return student loan bankruptcy defense back (like it was in the past before the train got off track) –just not most “American lawmakers,” which means you aren't representing “We the People.”{{10}}

** Also-this hurts over 45 Million Americans with student debt & another 40-50M cosigners/family: Over 100M+ total!!{{11}}

** Even BEFORE the pandemic, over 50% of ALL student loan borrowers weren't paying down their loans!..{{16}}

** While I don't support “forgiveness” of student debt, actually a good fraud case can be made based on both illegal removal of bankruptcy from loan contract{{12}}, illegal price-gouging{{13}}, and the fact that students have actually re-paid $1.22 for every $1.00 of just the defaulted student loans borrowed—certainly more considering loans in good standing—and that at illegal price-gouging levels.{{14}} Yes, it was paid-in-full—several times over, hello!?.. – probably more when you consider that loans in good standing have no repayment problems. Indeed, the government has been booking at least $50 Billion/year on the federal student loan portfolio since 2010.{{27}} Certainly far more than that in recent years, and this at illegally-inflated costs, to boot. (I add that qualifier because many people pay more than 100% on loans due to interest – car loans, house loans, etc. – but NONE of these are illegally-inflated principle costs, which are almost impossible to pay even before interest/fees.)

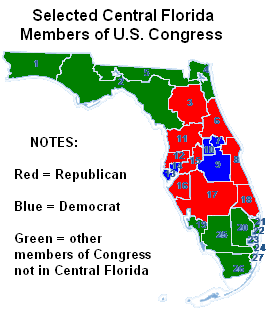

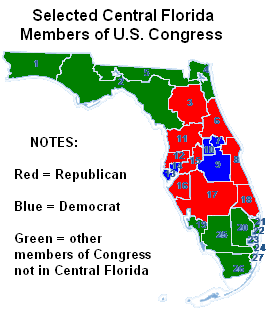

Selected

– scratch that – ALL Central Florida Members of U.S.

Congress

Rep. Matt Gaetz, R-FL-01 https://Gaetz.House.gov (202-225-4136, 850-479-1183)

Rep. Neal Dunn, R-FL-02 https://Dunn.House.gov (202-225-5235, 850-785-0812, 850-891-8610)

Rep. Kat Cammack, R-FL-03 https://Cammack.House.gov (202-225-5744, 352-505-0838, 904-276-9626)

Rep. John Rutherford, R-FL-04 https://Rutherford.House.gov (202-225-2501, 904-831-5205)

Rep. Al Lawson, D-FL-05 https://Lawson.House.gov (202-225-0123, 850-558-9450, 904-354-1652)

Rep. Michael Waltz, R-FL-06 https://Waltz.House.gov (202-225-2706, 386-302-0442, 386-279-0707,

386-238-9711)

Rep. Stephanie Murphy, D-FL-07 https://Murphy.House.gov (202-225-4035, 888-205-5421, 888-205-5421)

Rep. Bill Posey, R-FL-08 https://Posey.House.gov 202-225-3671, 321-632-1776, 321-383-6090, 772-226-1701

Rep. Darren Soto, D-FL-09 (202-225-9889, 407-452-1171, 407-452-1171, 202-600-0843, 202-615-1308,

202-322-4476, Odd-looking “202” area code, yes, but see e.g., https://Soto.House.gov/contact)

Rep. Val Demings, D-FL-10 https://Demings.House.gov (202-225-2176 or 321-388-9808)

Rep. Daniel Webster, R-FL-11 https://Webster.House.gov (202-225-1002, 352-241-9220, 352-383-3552,

352-241-9204, 352-241-9230)

Rep. Gus M. Bilirakis, R-FL-12 https://Bilirakis.House.gov (202-225-5755 or 727-232-2921)

Rep. Charlie Crist, D-FL-13 https://Crist.House.gov (202-225-5961 or 727-318-6770)

Rep. Kathy Castor, D-FL-14 https://Castor.House.gov (202-225-3376 or 813-871-2817)

Rep. C. Scott Franklin, R-FL-15 https://Franklin.House.gov (202-225-1252 or 863-644-8215)

Rep. Vern Buchanan, R-FL-16 https://Buchanan.House.gov (202-225-5015, 941-747-9081, 941-951-6643)

Rep. Gregory “Greg” W. Steube, R-FL-17 https://Steube.House.gov (202-225-5792 or 941-499-3214)

Rep. Brian Mast, R-FL-18 https://Mast.House.gov (202-225-3026, 772-336-2877, 772-403-0900,

561-530-7778)

Rep. Byron Donalds, R-FL-19 https://Donalds.House.gov (202-225-2536, 239-252-6225, 239-599-6033)

The late Rep. Alcee L. Hastings, D-FL-20 https://Clerk.House.gov/members/FL20/vacancy (202-225-1313, 202-225-7000)

Rep. Lois Frankel, D-FL-21 https://Frankel.House.gov (202-225-9890, 561-998-9045, 866-264-0957)

Rep. Ted Deutch, D-FL-22 https://TedDeutch.house.gov (202-225-3001, 561-470-5440, 954-972-6454, 954 255-8336)

Rep. Debbie Wasserman-Schultz, D-FL-23 https://WassermanSchultz.house.gov (202-225-7931, 954-845-1179, 305-936-5724 )

Rep. Fredrica Wilson, D-FL-24 https://Wilson.House.gov (202-225-4506, 954-921-3682, 305-690-5905, 954) 989-2688)

Rep. Mario Diaz-Balart, R-FL-25 https://MarioDiazBalart.house.gov (202-225-4211, (305) 470-8555, (239) 348-1620)

Rep. Carlos A. Gimenez, R-FL-26 https://Gimenez.House.gov (202-225-2778, (305) 222-0160, (305) 292-4485)

Rep. Maria Elvira Salazar, R-FL-27 https://Salazar.House.gov (202-225-3931, 305-668-2285)

Sen. Marco Rubio, R-FL https://Rubio.Senate.gov (202-224-3041, option 4 or 853-947-6288, or direct

cell to office mgr: 813-947-6292 or Orlando office – at 866-630-7106 and: (407) 254-2573 ; or: (305) 596-4224 ; or: (904) 354-4300 ; or: (850) 433-2603 ; or: (850) 599-9100 ; or: (239) 318-6464 ; or: (561) 775 3360)

Sen. Rick Scott, R-FL https://RickScott.Senate.gov (202-224-5274 or 813-225-7040 ; 407-872-7161 ; 850-760-5151 ; 850-942-8415 ; 904-479-7227 ; 407-586-7879 ; 561-514-0189 ; 239-231-7890 ; or, 786-501-7141)

Other Members of Congress: https://www.House.gov/representatives/find-your-representative

Other U.S. Senators: https://www.Senate.gov/general/contact_information/senators_cfm.cfm

S

ources:

{{1}} A 2014 article in the NY Times claims that: “A decade ago, there was only about $300 billion in such loans outstanding, and even now the $1.1 trillion in student loan debt is dwarfed by mortgage debt. But people who borrow money to pay for their education can’t simply walk away without paying, unlike with mortgages, car loans or credit cards; there is no equivalent of foreclosure, and student loan debts aren’t cleared by bankruptcy.” Source: “The Role of Student Debt in Stunting the Recovery,” by Neil Irwin, The New York Times, May 14, 2014:

https://www.nytimes.com/2014/05/15/upshot/the-role-of-student-debt-in-stunting-the-recovery.html Or: http://archive.vn/li1BW Or: https://web.archive.org/web/20200112041626/https://www.nytimes.com/2014/05/15/upshot/the-role-of-student-debt-in-stunting-the-recovery.html , NOTE: If a there were only $300 billion in student loans in 2004 (a decade before the 2014 article), and we're approaching almost $2 Trillion now, then we see that we've added $1.7 Trillion to U.S. Debt (we currently are the sole lenders of all student loans) in a space of sixteen (16) years: That's $106,250,000,000.oo, or more than $100 Billion per year, or about $290,896,646.13 every single day! (That does not even count the interest, which is not negligible!) Lawmakers' refusal to act upon this reasonable legislation, above, is directly and immediately responsible for adding almost 300 MILLION dollars to the national debt EVERY SINGLE DAY—and this WILL crash the dollar is left unchecked.

{{2}} Outstanding student debt is about $2 Trillion (probably most is interest and fees), and common knowledge, so no source is cited here. (As I write this, I'm offline, while my phone disables the internet because I'm “on hold” with call-in to Brian Kilmeade show, but can cite sources later. My phone won't do internet and phone at same time—yes, it's that cheap!)

{{3}} ******* 1 of 3: RICK SCOTT: “When I went to college in the 70’s, tuition was as low as $200 a semester, with no fees that I can remember.” Source: "Press Release," dated Tue. 10 Sept. 2019: By U.S. Sen. Rick Scott (R-FL), https://www.rickscott.senate.gov/sen-rick-scott-announces-proposals-lower-cost-higher-education Or: https://archive.vn/bOr5L Or: https://web.archive.org/web/20201026053431/https://www.RickScott.Senate.gov/sen-rick-scott-announces-proposals-lower-cost-higher-education (Editor's Note: that's only about a thousand dollars in today's money, adjusted for inflation. Source: https://ContractWithAmerica2.com/#freeREDUX or use Inflation calculator)

******* 2 of 3: WALL STREET JOURNAL (forgive the language--this is a direct quote) – QUOTE: "Al Lord, the former chief executive of student-loan giant Sallie Mae, has a complaint about higher education: The price of college is too damn high...The sting of high tuition hit him several years back when a grandson enrolled at the University of Miami, which currently charges $75,230 a year for tuition and room and board. That is a far cry from the $175 a semester Mr. Lord recalls paying for his own education at Penn State University in the 1960s. He has also paid for the education of three other grandchildren, to attend Villanova University, University of Miami and Davidson College. The bills have approached $200,000 a head. [] “It’s criminal,” he said of what schools are charging these days." Source: "Al Lord Profited When College Tuition Rose. He Is Paying for It.: As chief executive of student-lending giant Sallie Mae, Al Lord helped drive up the costs of college. Now that he is footing tuition checks for his grandchildren, he said he has new sympathy for ordinary families.," by Josh Mitchell, The Wall Street Journal, Published online and Updated July 23, 2021

******* 3 of 3: BERNIE SANDERS agrees and is verified as true by fact-checker: Was College once free in America? ANSWER: LIBERAL Senator Bernie Sanders says: “YES” Source: "Was college once free in United States, as Bernie Sanders says?," by Amy Sherman, PolitiFact, 09 February 2016, https://www.politifact.com/florida/statements/2016/feb/09/bernie-s/was-college-once-free-united-states-and-it-oversea Or: https://archive.vn/OBf9Q Or: https://web.archive.org/web/20201119105127/https://www.politifact.com/factchecks/2016/feb/09/bernies/was-college-once-free-united-states-and-it-oversea (Editor's Note: Whether you're "Liberal" and trust Bernie or "Conservative" and trust Rick Scott, ALL sides agree on this one point, and the evidence is quite overwhelming: College was free or real close to it – affordable – just decades ago.)

{{4}} QUOTE: “3. Third, if a college or university raises tuition or fees, they will be automatically cut off from ALL federal funding, including federally-guaranteed loan programs. That’s right, ALL FEDERAL FUNDING WILL BE CUT OFF IF TUITION OR FEES ARE INCREASED. [] We held the line on tuition in Florida, and we can do it nationally. There’s no reason universities should be raising costs on our students, even one bit. We can’t allow it.” Source: Source: "Press Release," dated Tue. 10 Sept. 2019: By U.S. Sen. Rick Scott (R-FL), https://www.rickscott.senate.gov/sen-rick-scott-announces-proposals-lower-cost-higher-education Or: https://archive.vn/bOr5L Or: https://web.archive.org/web/20201026053431/https://www.RickScott.Senate.gov/sen-rick-scott-announces-proposals-lower-cost-higher-education Or: https://contractwithamerica2.com/FannyDeregulation/SCOTT-PressRelease-Sept-10-2019_PDF.pdf

{{5}} QUOTE: “WASHINGTON, D.C. – Today, Senator Rick Scott released the following statement after reports that the Florida Board of Governors is considering a tuition increase for state university students. As Governor, Senator Scott fought to hold the line on tuition by vetoing tuition increases, eliminating automatic inflationary tuition increases, freezing tuition, greatly limiting tuition differential, and appointing leaders who share his goal of providing an affordable higher education to Florida students and families...Senator Rick Scott said, “Raising tuition on families is a tax increase. And, it’s a tax increase that harms Floridians’ ability to achieve the American dream of earning a highereducation diploma. As families are still struggling to recover from the coronavirus, leaders in Florida should absolutely not consider raising tuition.” SOURCE: “Sen. Rick Scott to Florida Board of Governors: Do Not Raise Tuition on Florida Students,” Press Release dated: Monday, November 30, 2020: https://www.rickscott.senate.gov/sen-rick-scott-florida-board-governors-do-not-raise-tuition-florida-students Or: https://archive.vn/uONHw Or: https://web.archive.org/web/20201209181658/https://www.rickscott.senate.gov/sen-rick-scott-florida-board-governors-do-not-raise-tuition-florida-students SEE ALSO: https://www.floridadaily.com/rick-scott-raising-tuition-on-families-is-a-tax-increase Or: https://archive.vn/CyDEm Or: https://web.archive.org/web/20201202031211/https://www.floridadaily.com/rick-scott-raising-tuition-on-families-is-a-tax-increase

{{6}} “VII. COST$ of COLLEGE,” Source: CONTRACT WITH AMERICA: PART II(tm), Links: https://ContractWithAmerica2.com/#college Or: https://GordonWatts.com/n.index.html#college Or: https://GordonWayneWatts.com/n.index.html#college

{{7}} See the last 2 pages of

LINK: https://GordonWatts.com/GordonWayneWatts_AMENDED_Testimony_SenateJudiciary_Tue03Aug2021_Proposed.pdf

Archive-1: https://archive.vn/Ibeak Archive-2: https://web.archive.org/web/20210819165721/https://contractwithamerica2.com/Testimony/GordonWayneWatts_AMENDED_Testimony_SenateJudiciary_Tue03Aug2021_Proposed.pdf

{{8}} Sen. Josh Hawley (R-MO) Conservative Republican: Heritage Action continually ranks Sen. Hawley very Conservative, 94%, this session, well-above the 83% mark for “AVERAGE SENATE REPUBLICAN”: LINK: https://HeritageAction.com/scorecard/members/H001089/117 LINK: https://Archive.vn/McmON LINK: https://Web.Archive.org/web/20210419070849/https://heritageaction.com/scorecard/members/H001089/117

Senator Hawley is a Cosponsor of S.2598 - FRESH START Through Bankruptcy Act, 117th Congress (2021-2022) LINK: https://www.Congress.gov/bill/117th-congress/senate-bill/2598/cosponsors SENATOR JOSH HAWLEY (R-MO) quote from the recent Senate Judiciary Committee hearing on S.2598: “There are a couple of things that I wanted to focus on: The first is that, while I don't support cancellation of all student debt, for the reasons that have been talked about – the massive – I think – subsidy to wealthier Americans and also the massive subsidy to universities – I want to say that I can't think of very many good reasons to keep students with massive amounts of debts as lifelong serfs of banks – and lifelong serfs of universities by not allowing them to discharge in bankruptcy of their debt under appropriate circumstances.” TIME-STAMPS: 1:26:41—1:27:09 in local video, and 1:40:56—1:41:24 in official Senate website video, download links below: S.2598 Senate Judiciary Committee hearing – DOWNLOAD LINKS: Flagship mirror: https://ContractWithAmerica2.com/#bankruptcy

Mirror-1: https://GordonWatts.com/n.index.html#bankruptcy Mirror-2: https://GordonWayneWatts.com/n.index.html#bankruptcy Archive-1: https://Archive.vn/cbLka#bankruptcy Archive-2: http://Web.Archive.org/web/20211122233936/https://contractwithamerica2.com/#bankruptcy SENATE LINK: https://www.Judiciary.senate.gov/meetings/student-loan-bankruptcy-reform YouTube: https://YouTu.be/0___nZTj98k

Facebook: https://www.Facebook.com/GordonWayneWatts/videos/585970785734005 Download: https://ContractWithAmerica2.com/FannyDeregulation/SenateJudiciaryHearing_Tue-08Aug2021_MOV.mov

{{9}} LINK: https://GordonWatts.com/Supporters-StudentLoanBankruptcy-only-FINAL.pdf (PDF format)

Or: https://GordonWayneWatts.com/Supporters-StudentLoanBankruptcy-only-FINAL.pdf (PDF format)

Or: https://ContractWithAmerica2.com/Supporters-StudentLoanBankruptcy-only-FINAL.pdf (PDF format)

Or: https://ContractWithAmerica2.com/Supporters-StudentLoanBankruptcy-only-FINAL.html (Webpage format)

Archive-1: https://Archive.vn/njFTa (Webpage format)

Archive-2a: http://Web.Archive.org/web/20211221010334/https://contractwithamerica2.com/Supporters-StudentLoanBankruptcy-only-FINAL.html (Webpage format)

Archive-2b: http://Web.Archive.org/web/20211221010322/https://contractwithamerica2.com/Supporters-StudentLoanBankruptcy-only-FINAL.pdf (PDF format)

{{10}} THE POLLS:

** Forbes reports, among other things, that 67% of Americans (incl. 58% of Republicans) support “widespread” student loan forgiveness—with only 26% in opposition, while another “33% of voters think that for-profit schools shouldn’t get federal funds at all.” Source: “New Poll Shows Substantial, Bipartisan Support For Student Loan Forgiveness And Other Relief For Borrowers,” by Adam S. Minsky, FORBES, September 25, 2020, 11:52am (EDT) –

*8 The Harris Poll finds similar sentiments among Americans, “such as forgiveness of a flat amount of student debt (64%) and forgiveness of all student loan debt (55%), are supported by more than half the country,” as well as “updating bankruptcy laws to get rid of student debt (66%)” and “restrictions or price controls on the cost of a university education (78%).” Source: “Americans Overwhelmingly Support Student Debt Reform: The majority of Americans support reforms to student loans and education costs, and most think the new presidential administration is up to the task.,” The Harris Poll, December 2020

** After reporting on The Harris Poll, cited above, INSIDE HIGHER ED then goes on to report that “Our [own] survey also confirms the crippling effects of student debt on borrowers -- and the economy. According to the latest government statistics, 42.3 million people -- one in every six adults -- have federal student loans, averaging $36,520 per person...Of the 10 solutions we offered our 1,015 survey takers, majorities endorsed every single one. Support peaks at 83 percent for low-interest loans for students at public colleges and universities, 78 percent for government price controls on higher education costs, and 72 percent for automatic student debt forbearance for the unemployed. Backing for these fixes was lopsided among every generation, family type and income and racial group. [] What is more surprising is how many Americans embrace certain correctives that were dismissed as impractical and even socialist during the 2020 election campaign.” Source: “Are Americans Turning ‘Socialist’ About Student Debt?,” by Will Johnson, INSIDE HIGHER ED, January 19, 2021 (See reference {{9}} above for links to this also.)

{{11}} OVER 100 MILLION AMERICANS: This hurts over 45 Million Americans with student debt and another 40-50 Million who are cosigners, family/friends, etc., about 100M Americans. BIG PROBLEM – PROOF: From reputable news sources, we know that over 44 Million Americans hold student debt—and these are older figures. It's probably much higher now—and exasperated by the Pandemic Economic Depression:

** 1st source: “Amnesty Advocates Help Illegal Immigrants Get College Scholarships While 44.7 Million Americans Saddled with Student Debt,” by Penny Starr, BREITBART, 12 April 2019 https://www.breitbart.com/politics/2019/04/12/amnesty-advocates-help-illegal-immigrants-get-college-scholarships-while-44-7-million-americans-saddled-with-student-debt

** 2nd source: QUOTE: “In 2017, student-loan debt hit a record high of $17,126 per graduate who took out loans, Business Insider reported. In 2018, the national total of student-loan debt was $1.5 trillion, according to Student Loan Hero, and more than 44 million Americans share the burden of carrying it.” SOURCE: “Nearly half of indebted millennials say college wasn't worth it, and the reason why is obvious,” by Hillary Hoffower, Business Insider, April 11, 2019, 1:09 PM https://businessinsider.com/millennials-college-not-worth-student-loan-debt-2019-4

** 3rd source: QUOTE: “Our immediate source of revenue will be a SaaS-based pricing model of $6/month for each employee that participates with no setup costs or annual fees. 44 million Americans have student debt, charging $6/month x 12 months would produce $3.16 billion in ARR. [] The total U.S. student loan market is $1.5 trillion (larger than all consumer credit cards and auto loans) and growing by $2,726 per second.” SOURCE: “Read the application form that got a company with $0 in the bank into the selective startup accelerator that launched Airbnb and Dropbox,” by Shana Lebowitz, Business Insider, October 27, 2020, 9:20 AM: https://businessinsider.com/successful-y-combinator-application-goodly-new-student-debt-startup-2019-4 Or: https://archive.vn/5WQKW Or: https://web.archive.org/web/20210202105343/https://www.businessinsider.com/successful-y-combinator-application-goodly-new-student-debt-startup-2019-4

** 4th source: QUOTE: “Warren says her plan would erase some debt for more than 95% of the nearly 45 million Americans with student loans — and would completely wipe out student loan debt for more than 75% of Americans who carry it.” SOURCE: “Elizabeth Warren’s New $640 Billion Student Debt Cancellation Plan,” by Yuval Rosenberg, The Fiscal Times, April 22, 2019 http://thefiscaltimes.com/2019/04/22/Elizabeth-Warren-s-New-640-Billion-Student-Debt-Cancellation-Plan

** 5th source: https://www.google.com/search?q=How+Many+Americans+Have+Student+Loan+Debt

** 6th source: https://search.yahoo.com/search?p=How+Many+Americans+Have+Student+Loan+Debt

** 7th source: https://www.bing.com/search?q=How+Many+Americans+Have+Student+Loan+Debt

{{12}} QUOTE: “It is not illegal to alter a contract once it has been signed. However, it must be materially changed, meaning that if an important part of the contract is altered by the change, it must be made by mutual consent of both parties. If only one party modifies the contract without the agreement of the other, then it is unlikely the changes will be enforceable.” Source: “Contract Alteration: Everything You Need to Know,” by UpCounsel, © 2020 UpCounsel, Inc., https://www.upcounsel.com/contract-alteration – QUOTE: “BAPCPA also removed bankruptcy protections on student debt for private student loans. This was the culmination of several decades of reduced protections on student loans, starting in the late 1970s. First student loans weren’t dischargeable in bankruptcy during their first five years. Then, in 1996, Social Security payments became eligible to be garnished to pay student loans. In 1998, the statute of limitations was removed so that public student loans were never dischargeable. BAPCPA extended all this to private loans. At the time, the private lender Sallie Mae pushed for this reform above all others. A study by Mark Kantrowitz found that this change did little to increase the availability of private student loans to students with poor credit, which is precisely what it was supposed to do (Konczal 2011).” SOURCE: “A NEW REPORT BY THE ROOSEVELT INSTITUTE AIMS TO ESTABLISH A SOLID DEFINITION OF FINANCIALIZATION.”. – SEE ALSO: “In 1998 The Higher Education Amendments of 1998 removed bankruptcy discharge for student loans after seven years in repayment, and made student loans almost entirely non-dischargeable.6 The law took effect on October 7, 1998 and thus borrowers who reached their seventh year of repayment before the reform had discharge available, while borrowers who reached their seventh year of repayment after the reform were unable to discharge their students loans in bankruptcy.” [] “6There are rare cases in which students loan borrowers can prove undue hardship and discharge student loans. See appendix A for more on student loan bankruptcy.” SOURCE:“Future Conferences - Financial Management Association – Title: “Strategic Default on Student Loans,”, by Constantine Yannelis†, †Department of Finance, NYU Stern School of Business, New York, NY 10012. constantine.yannelis@stern.nyu.edu, October 2016, LINKS: https://ContractWithAmerica2.com/#contract

** Mirror-1: https://GordonWatts.com/n.index.html#contract Mirror-2: https://GordonWayneWatts.com/n.index.html#contract

{{13}} LINKS: https://ContractWithAmerica2.com/#price

** Mirror-1: https://GordonWatts.com/n.index.html#price Mirror-2: https://GordonWayneWatts.com/n.index.html#price

{{14}} STUDENT BORROWERS HAVE RE-PAID ALL STUDENT DEBT -- TWICE and THEN SOME: Yes, you read correctly: The first time was when taxpayers (which included student borrowers) repaid colleges in full when -- due to a little-known provision of the Affordable Care Act, signed into law in 2010 -- taxpayers PURCHASED (yes, BOUGHT) all federally-held student debt. (Thus, the debt has been paid in full, and cancellation would cost nothing – well, unless you include the fact that the over-charged victims would be allowed to stop paying, but as they've already re-paid and *over-paid*, they *should* be allowed to stop paying.) The 2ND time the debt was re-paid? Students have repaid taxpayers $1.22 for EVERY $1.00 that taxpayers have lent them of just the defaulted student loans, and this at illegally-inflated costs, to boot. (I add that qualifier because many people pay more than 100% on loans due to interest – car loans, house loans, etc. – but NONE of these are illegally-inflated principle costs, which are almost impossible to pay even before interest/fees.)

* Indeed, almost all student loans are owned – not guaranteed – by the taxpayer: “Most student loans – about 92%, according to a December 2018 report by MeasureOne, and academic data firm – are owned by the U.S. Department of Education.” Source: “2019 Student Loan Debt Statistics,” by Teddy Nikiel, NerdWallet, December 20, 2019: https://www.nerdwallet.com/blog/loans/student-loans/student-loan-debt Or: https://archive.vn/OyBHz Or: https://web.archive.org/web/20200824041614/https://www.nerdwallet.com/blog/loans/student-loans/student-loan-debt/

* INVESTOPEDIA confirms this: “As of July 8, 2016, the federal government owned approximately $1 trillion in outstanding consumer debt, per data compiled by the Federal Reserve Bank of St. Louis. That figure was up from less than $150 billion in January 2009, representing a nearly 600% increase over that time span. The main culprit is student loans, which the federal government effectively monopolized in a little-known provision of the Affordable Care Act, signed into law in 2010. [] Prior to the Affordable Care Act, a majority of student loans originated with a private lender but were guaranteed by the government, meaning taxpayers foot the bill if student borrowers default.” Source: “Who Actually Owns Student Loan Debt?,” by Sean Ross, INVESTOPEDIA, Updated April 10, 2020: https://www.investopedia.com/articles/personal-finance/081216/who-actually-owns-student-loan-debt.asp Or: https://archive.vn/IyDym Or: https://web.archive.org/web/20210121021409/https://www.investopedia.com/articles/personal-finance/081216/who-actually-owns-student-loan-debt.asp

What this means, in plain English, is that prior to the ACA (ObamaCare), taxpayers GUARANTEED most student debt, meaning we would pay if the student defaults. Now, however, thanks to ACA, taxpayers (you and me) OWN almost all student debt. So, all those “yahoos” who keep saying they don't want to “pay” for your college (student debt)...well, too late: THE VERY SECOND that the loans are taken out, taxpayers paid for it. Period. Colleges are paid immediately. So, as the government OWN$ federally-held student debt, forgiveness would cost NOTHING – well, unless you include the fact that the over-charged victims would be allowed to stop paying, but as they've already re-paid and *over-paid*, they *should* be allowed to stop paying: The college loans are paid off COMPLETELY the very moment the loan is issued—whereby the student is a “conduit” or “pass through” of obscenely huge sums of money, passing from taxpayer to uber-rich colleges/universities (many charging full price but denying on-campus learning due to PANDEMIC excuses: Garbage men go to work every day, as do police, fire, paramedics, nurses, and doctors, but many colleges, who think they're “better than” our 1ST responders, shut out students—yet charge them full price). In case the reader doesn't “get it,” imagine that Mary Jane Doe owes John Doe a TRILLION DOLLAR$, and then imagine John “forgives” the entire debt, ok? Would that cost ANYONE anything? No! (All this would mean is that the pittance of pennies that Mary Jane was paying to John – if even that – that “trickle” of pennies would STOP, and John's income-stream would very-slightly decrease.) If, on the other hand, John “guaranteed” the debt, he would have to pay it upon Mary Jane's default. But, at present, almost NO “legacy” loans exist which are guaranteed, so please stop saying “students are trying to get taxpayer to 'pay' their debt.” No! It's ALREADY BEEN PAID... the very SECOND the loans are taken out. And—I'll add—many of these “so-called” (fake) Conservatives “beating the drum” are 100% at fault: If they spend even half the energy demanding lawmakers STOP wasting MY taxpayer dollar to make sub-prime toxic collegiate loans as they did complaining about so-called “deadbeat” or “free handout” students, then GOP lawmakers would have LONG AGO introduced a bill to lower collegiate loan limits (which is really a spending cuts: MY tax dollars are used to make or back said loans), thus stopping the use of tax dollars to make/back collegiate loans. Which they CLAIM they're against. But don't do anything to stop this pork barrel spending hemorrhaging bleed-out of our precious taxpayer dollars—hurting students on the hook, and taxpayers who pay, and helping only a few rich, Liberal Swamp creatures in higher ed, who no longer charge affordable prices—as in times past.

TRUE Conservatives have, for years—for decades—have complained about excess spending of taxpayer dollars to make or guarantee student loans, and if you -- the reader -- are a "true Conservative" who complains about all these Liberal Free Handouts, then STOP complaining and, instead, click THIS link -- and ACT to join other true Conservatives herewith. ALL (not “almost all,” but ALL) College debt was “PAID IN FULL” –— TWICE Now, I just showed that almost ALL college debt is PAID IN FULL, above, and “cancellation” would cost NO tax dollars, but actually ALL college debt (not almost all, but ALL) has been MORE-THAN “paid in full” – TWICE: Here is the second time it was paid for:

Students have paid back $1.22 for EVERY $1.00 that taxpayers have lent them of just the defaulted student loans, and this at illegally-inflated costs, to boot. I add that qualifier because many people pay more than 100% on loans due to interest – car loans, house loans, etc. – but NONE of these are illegally-inflated principle costs, which are almost impossible to pay even before interest/fees. PROOF:

QUOTE 1 of 3: “According to White House budget figures for fiscal 2011 ending in September, the federal government expects gross recovery of between $1.10 and $1.22 for every dollar of defaulted student loans. An estimated $49.9 billion of Federal Family Education Loan and Federal Direct Lending Program loans are in default, out of a total $713.4 billion outstanding, as of Sept. 30. Those amounts include only principal balances, not interest.” Source: “COLLEGE PLANNING: Government Sees High Returns On Defaulted Student Loans,” by Melissa Korn, WSJ (The Wall Street Journal), Updated Jan. 4, 2011, 3:14 p.m. (EST), LINK: https://www.WSJ.com/articles/SB10001424052748704723104576061953842079760 Or: https://Archive.vn/yKQnH

* QUOTE 2 of 3: “In 2010 the Department of Education reported collecting $1.22 for every dollar in defaulted student loans it had guaranteed - and that’s after the sharks and their shareholders and the obligatory outright fraud had taken their first round of cuts.” Source: “Column: The student loan crisis that can't be gotten rid of,” by Maureen "Moe" Tkacik (12 Minute Read), REUTERS, August 15, 2012: https://www.reuters.com/article/us-student-loan-crisis/column-the-student-loan-crisis-that-cant-be-gotten-rid-of-idUSBRE87E13L20120815 Or: https://archive.vn/x4gkq Or: https://web.archive.org/web/20200704205750/https://www.Reuters.com/article/us-student-loan-crisis/column-the-student-loan-crisis-that-cant-be-gotten-rid-of-idUSBRE87E13L20120815

* QUOTE 3 of 3: “It is most disturbing, however, that recent analysis of the President's Budget data reveals that even the US Department of Education, on average, recovers $1.22 for every dollar paid out in default claims. Assuming generous collection costs, and even allowing for a nominal time value of money of a few percent (the governments cost of money is very low), it still appears that the federal government, even, is making a pretty penny from defaults.” Source: “Why College Prices Keep Rising,” by Alan Collinge, FORBES, (in Peter J. Reilly's column), March 19, 2012: https://www.forbes.com/sites/peterjreilly/2012/03/19/why-college-prices-keep-rising Or: https://archive.vn/VvZcJ Or: https://web.archive.org/web/20200630152844/https://www.forbes.com/sites/peterjreilly/2012/03/19/why-college-prices-keep-rising

For further information:

Flagship mirror: https://ContractWithAmerica2.com/#PaidInFull

Mirror-1: https://GordonWatts.com/n.index.html#PaidInFull Mirror-2: https://GordonWayneWatts.com/n.index.html#PaidInFull

{{15}} QUOTE: “Today, FSA's [student debt] portfolio is nearly 10 percent of our nation's debt. [] Stop and absorb that for a moment. Ten percent of our total national debt.” Source: U.S. Dept of Education, Sec. of Education, Betsy DeVos, 11-27-2018 speech: Archive-1: https://archive.vn/aRKbd (Dept of Ed removed this page, so we must rely upon archives here)

Archive-3: https://gordonwatts.com/DeVos-speech_11-27-2018_PDF.pdf

Archive-4: https://gordonwaynewatts.com/DeVos-speech_11-27-2018_PDF.pdf

Archive-5: https://contractwithameric2.com/DeVos-speech_11-27-2018_PDF.pdf

{{16}} Department of Education: Over half of federal student loan borrowers were not paying before Pandemic: That's right -- even before the Pandemic, over fifty (50%) percent were NOT paying on student loans. So, you can only *imagine* what problems we face now. This undersigned writer was "freaked out": Even before the pandemic!?.. So, my boss requested a "fact check" on this issue. ** Student debt advocate and expert, Alan M. Collinge, writes an article, making this claim: “Department of Education: Over half of federal student loan borrowers were not paying before Pandemic.,,” by Alan Collinge, MEDIUM.com,Nov. 10, 2011: https://studentloanjustice.medium.com/department-of-education-54-of-federal-student-loan-borrowers-were-not-paying-before-pandemic-2d2c45348958 Or: https://archive.vn/JHHQk Or: https://web.archive.org/web/20211111000325/studentloanjustice.medium.com/department-of-education-54-of-federal-student-loan-borrowers-were-not-paying-before-pandemic-2d2c45348958 Mr. Collinge provides readers with a chart to support his claims, which are reproduced in the “fact checking” article that this undersigned writer wrote to fact-check Collinge: After crunching the numbers from the Dept of Ed itself (you can click the Dept of Ed links and verify me), almost al of Collinge's claims were verified (except for a few numbers that seemed to be typos.) I.e., he seemed mostly correct.

Thus, if over half were unable to repay even before the Pandemic, this writer would be very surprised if even 10% or 20% are able to repay on these highly-inflated loans once the "pause" ends (now "post-Pandemic") and payments resume on Jan. 31, 2022. Therefore, it seems very necessary that S.2598 and H.R.4907 be speedily passed into law for "tamp down" the dangerous excesses in lending -- using your taxpayer dollars -- which are wasted on this failed lending system to the tune of about two trillion dollars.

Flagship mirror: https://ContractWithAmerica2.com/#OverHalfNotPaying

Mirror-1: https://GordonWatts.com/n.index.html#OverHalfNotPaying

Mirror-2: https://GordonWayneWatts.com/n.index.html#OverHalfNotPaying

Archive-1: https://Archive.vn/5xX2Q#OverHalfNotPaying

Archive-2: http://Web.Archive.org/web/20211209115917/https://contractwithamerica2.com/#OverHalfNotPaying

{{17}} Over Ninety-Nine (99%) Percent of ALL PSLF (Public Service Loan Forgiveness) applicants are rejected: Yes, you read correctly: Almost ONE-HUNDRED (100%) PERCENT of ALL PSLF applicants for forgiveness of student loans are rejected! So much for trying to "play by the rules" and "work off" your college debt with Public Service.

Source: “The U.S. already has student debt forgiveness—but barely anyone gets it,” by Abigail Johnson Hess (@ABIGAILJHESS), CNBC, Published Tue., Mar. 23 2021, 2:02PM(EDT), Updated Wed., Mar. 24 2021, 9:32AM(EDT),

ARCHIVE-1: https://Archive.vn/P8eLS

For More Info: https://ContractWithAmerica2.com/#PSLFfailure

{{18}} $$$ CRASH of the DOLLAR WARNING: Failure to pay close attention here -- and here on out -- WILL result in a CRA$H of the U.S. DOLLAR! Do NOT say you weren't warned: We are warning you right here and now. $$Two Trillion Dollars is a LOT of money!

** We go almost THREE-HUNDRED MILLION ($300,000,000.oo) DOLLAR$ per DAY in debt due to Lawmakers' refusal to STOP harmful pork subsidies to make/back UNNECESSARY higher ed loans **

You heard right on both counts: Since college was almost FREE in America{{3}} in the very recent past, there WERE no student loans, and thus no student loan debt -- and, by logical extension, no need for taxpayers to subsidize said debt, thus no need for these subsidies exists now. Moreover, numerous fiscally-responsible lawmakers (read: YOU) (allegedly) want to cut wasteful pork spending: However, we haven't been able to, and here is math supporting this claim:

A 2014 article in the NY Times claims that: “A decade ago, there was only about $300 billion in such loans outstanding, and even now the $1.1 trillion in student loan debt is dwarfed by mortgage debt. But people who borrow money to pay for their education can’t simply walk away without paying, unlike with mortgages, car loans or credit cards; there is no equivalent of foreclosure, and student loan debts aren’t cleared by bankruptcy.” Source: “The Role of Student Debt in Stunting the Recovery,” by Neil Irwin, The New York Times, May 14, 2014,

LINK: https://www.NYTimes.com/2014/05/15/upshot/the-role-of-student-debt-in-stunting-the-recovery.html

Archive-1: http://Archive.vn/li1BW

Archive-3: https://GordonWatts.com/StudentDebt-NYTimes-5-14-2014_viaArchiveToday.pdf

Archive-4: https://GordonWayneWatts.com/StudentDebt-NYTimes-5-14-2014_viaWaybackMachine.pdf

For more information: https://ContractWithAmerica2.com/#pork

{{19}} The 2008 U.S. Housing Crisis – by the numbers – from The Federal Reserve—QUOTE: “On average, 1.5 percent of subprime loans in the 2000-2004 vintages were in default after 12 months, and the situation was just a bit worse for the 2005 vintage (Figure 2).3 However, 2 percent of outstanding loans in the 2007 vintage were in default within six months of origination, and 8 percent were in default after 12 months...As noted earlier, California, Florida, Arizona, and Nevada experienced much higher house price appreciation over the first few years of the 2000s than the rest of the nation. Correspondingly, only about 3 percent of subprime mortgages originated in these states from 2000 to 2004 defaulted within 3 years of origination, compared with over 8 percent of subprime mortgages originated in the nation overall. [] As house prices began to decelerate in 2005, this pattern began to reverse. Over 17 percent of the subprime mortgages that originated in California, Florida, Arizona, and Nevada in 2005 defaulted by mid-2008, compared with nearly 14 percent nationwide. In 2006, house prices began to drop more sharply than in these states. Around 26 percent of 2006 subprime mortgage originations and 18 percent of 2007 subprime mortgage originations in California, Florida, Arizona, and Nevada were in default as of mid-2008. For the nation as a whole, only 13 and 9 percent of subprime mortgages originated in these years were in default.”

Source: “The Rise in Mortgage Defaults,” by Chris Mayer, Karen Pence, and Shane M. Sherlund, The Federal Reserve Board, November 2008 ; Last update: November 20, 2008,

LINK: https://www.FederalReserve.gov/pubs/FEDS/2008/200859

LINK: https://www.FederalReserve.gov/pubs/feds/2008/200859/200859pap.pdf

Archive-1: https://Archive.vn/uKvgJ

Archive-2a: https://Web.Archive.org/web/20100523143434/https://www.federalreserve.gov/pubs/FEDS/2008/200859

See also: https://ContractWithAmerica2.com/#SuperHighDefaultRate

{{20}} EXPERTS PREDICT AS MUCH AS EIGHTY-FIVE (85%) PERCENT OF ALL STUDENT LOAN BORROWERS WILL NEVER BE ABLE TO REPAY THESE ILLEGALLY-INFLATED PRICE-GOUGED COLLEGIATE LOANS: Yes, you read correctly: Eighty-Five (85%) Percent of ALL students are expected to default and/or otherwise never repay their loans before they die, graveyard dead:

Having already proved and documented that costs of college are well-beyond "price-gouging" standards in any other industry, and having shown that students have still been able to pay off these illegally-inflated costs, it should make the reader nauseous and sick to learn that the vast majority will still keep paying on these loans and likely never repay them. Strong claims, eh? PROOF:

* QUOTE 1 of 3: “Trends for the 1996 entry cohort show that cumulative default rates continue to rise between 12 and 20 years after initial entry. Applying these trends to the 2004 entry cohort suggests that nearly 40 percent of borrowers may default on their student loans by 2023.” Source: “The looming student loan default crisis is worse than we thought,” by Judith Scott-Clayton, The Brookings Institute, Thursday, 11 January 2018,

LINK: https://www.Brookings.edu/research/the-looming-student-loan-default-crisis-is-worse-than-we-thought

Archive-1: https://Archive.vn/OI3TK

QUOTE 2 of 3: Student loan defaults were “running at about 40% for 2004 borrowers. And those borrowers were only borrowing one-third of what students are borrowing currently. One can only wonder how bad the internal projections must be for more recent students.” Source: “One inexpensive and easy fix for the student loan problem,” by Alan M. Collinge, The Washington Examiner, November 29, 2019,

Archive-1: https://Archive.vn/652KY

Furthermore, Dr. A. Wayne Johnson, Conservative Republican, who was a recent COO (Chief Operating Officer) of the U.S. DEPARTMENT OF EDUCATION'S Federal Student Aid Program, is probably the nation's top expert on American Higher Education lending—and he estimates that more than EIGHTY-FIVE (85%) PERCENT of Student Loans in American Higher Ed will NEVER be repaid:

* QUOTE 3 of 3: ““The full measure of my campaign is focused on the student loan debt in this country,” he said. “The system is terribly broken. It is an abomination, and can destroy the fabric of America. It has only one beneficiary: the colleges and universities. They can charge whatever tuition they want to, since they get the money essentially from the students, debt free and without a credit check. [] “There is an unlimited insatiable appetite on the part of the colleges to encourage students to take out loans.” [] He emphasizes that 44 million people owe student debt. “And more than 85 percent of these loans will never get repaid. It’s a poison students don’t recognize they are getting into when they take out loans. They don’t realize until later in life that it will eat their life away.”” – Source: “BRACK: Johnson bases Senate campaign on student loan reform,” by Elliott Brack, Editor & Publisher of GwinnettForum, GWINNETT FORUM: Gwinnett County's community forum and idea exchange, Friday, September 11, 2020, 4:53 am (EDT),

LINK: https://www.GwinnettForum.com/2020/09/brack-johnson-bases-senate-campaign-on-student-loan-reform

Archive-1: https://Archive.vn/wip/Op58d

{{21}} STUDENT DEBT is not a "young person's problem," but rather an "older person's problem": Older people outnumber younger people with student loans, and they owe far more. Specifically, a recent Facebook post, citing U.S. DEPARTMENT OF EDUCATION data, the author claims that “There are MORE people OVER 50 than UNDER 25 with student loan debt, MORE people OVER 35 than UNDER 35 with student loans...and the older groups owe FAR MORE IN BOTH CASES.” In his post, he claims that “NO ONE KNOWS THIS,” and goes on to ask “WHAT WILL YOU DO TO SPREAD THE WORD ABOUT IT?!” The author then goes on to clarify and document his claims in a post to MEDIUM: “Older people outnumber younger people with student loans, and they owe far more.,” by Alan Collinge, MEDIUM, December 25, 2020:

Archive-1: https://Archive.vn/5RE4G

This undersigned author looked directly at the Dept of Ed data,

LINK: https://StudentAid.gov/sites/default/files/fsawg/datacenter/library/Portfolio-by-Age.xls

After looking at the data, this undersigned writer fact-checked the author of that article, we rate, as true, his claims that STUDENT DEBT is not a "young person's problem," but rather an "older person's problem" and his claim that Older people outnumber younger people with student loans, and they owe far more.

LINK: https://ContractWithAmerica2.com/#older

Mirror-1: https://GordonWatts.com/n.index.html#older

Mirror-2: https://GordonWayneWatts.com/n.index.html#older

Archive-1: https://Archive.vn/5xX2Q#older

Archive-2: http://Web.Archive.org/web/20211209115917/https://contractwithamerica2.com/#older

{{22}} QUOTE: "Four years after graduating college, black students owe nearly twice as much student debt as their white peers do and are three times more likely to default on those loans, according to a new paper by the Brookings Institution." SOURCE: “Black College Grads Have Twice as Much Student Debt as Whites,” by Kerri Anne Renzulli, TIME, Oct 21, 2016,

LINK: https://Money.com/student-debt-racial-gap/

Archive-1: https://Archive.vn/vyel0

Archive-2: https://Web.Archive.org/web/20210312220337/https://money.com/student-debt-racial-gap/

See also: “REPORT: Black-white disparity in student loan debt more than triples after graduation ,” by Judith Scott-Clayton and Jing Li, The Brookings Institution, Thursday, October 20, 2016,

Archive-1: https://Archive.vn/dijYs

{{23}} NINETEEN (19) STATES HAVE HIGHER Student-Loan DEBT THAN THEIR ANNUAL STATE BUDGETS: Yes, you read correctly: Even though college was once FREE in the recent past -- and even in spite of having Paid in FULL several times over "costs of college" (and this even at illegally-inflated price-gouging costs), no less than nineteen (19) U.S. States hold more collegiate loan debt than their entire annual state budgets! So, it's no surprise that experts predict close to One-Hundred (100%) Percent of ALL students will NEVER be able to repay their college debt –even tho they've repaid it several times over & CONTINUE to repay on subprime, toxic loans issued under monopoly-based and predatory lending conditions. "Liberal" overtaxation on steroids, as we recall that Sen. Rick Scott (R-FL), and other conservatives, rightly call tuition a tax. QUOTE: “The student-debt problem numbers are massive: 45 million people owe $1.7 trillion. But another big number is 19, as that many states have more outstanding student debt than their annual budgets. [] Student Loan Justice — an organization advocating for student-debt cancellation — released a report in March on these 19 states, with Georgia, Florida, and Missouri topping the list at 169%, 148%, and 141% of debt owed relative to their budgets, respectively, and South Carolina and New Hampshire close behind at 135% and 131%. [] To put that in perspective, Georgia's state budget is slightly more than $48 billion, but Georgians' total student debt comes close to $82 billion..."There is no easier or cheaper way than to simply cancel it by executive order," Collinge said. "You don't need to raise one dime in tax, and you don't add anything to the national debt, so I think to most common-sense thinkers, this is the low-hanging fruit on the economic stimulus tree."” Source: “19 states have higher student-loan debt than annual budgets, report ,” by Ayelet Sheffey, BUSINESS INSIDER, April 5, 2021, 8:55 PM,

Archive-1: https://Archive.vn/Y2n3i

{{24}} Forbes reports, among other things, that 67% of Americans (incl. 58% of Republicans) support “widespread” student loan forgiveness—with only 26% in opposition, while another “33% of voters think that for-profit schools shouldn’t get federal funds at all.” Source: “New Poll Shows Substantial, Bipartisan Support For Student Loan Forgiveness And Other Relief For Borrowers,” by Adam S. Minsky, FORBES, September 25, 2020, 11:52am (EDT),

Archive-1: https://Archive.vn/t9gXQ

See also: https://ContractWithAmerica2.com/#polls

The Harris Poll finds similar sentiments among Americans, “such as forgiveness of a flat amount of student debt (64%) and forgiveness of all student loan debt (55%), are supported by more than half the country,” as well as “updating bankruptcy laws to get rid of student debt (66%)” and “restrictions or price controls on the cost of a university education (78%).” Source: “Americans Overwhelmingly Support Student Debt Reform: The majority of Americans support reforms to student loans and education costs, and most think the new presidential administration is up to the task.,” The Harris Poll, December 2020,

LINK: https://TheHarrisPoll.com/student-debt-reform

Archive-1: https://Archive.vn/yy68M

Archive-2: https://Web.Archive.org/web/20210929203921/https://TheHarrisPoll.com/student-debt-reform

See also: https://ContractWithAmerica2.com/#polls

After reporting on The Harris Poll, cited above, INSIDE HIGHER ED then goes on to report that “Our [own] survey also confirms the crippling effects of student debt on borrowers -- and the economy. According to the latest government statistics, 42.3 million people -- one in every six adults -- have federal student loans, averaging $36,520 per person...Of the 10 solutions we offered our 1,015 survey takers, majorities endorsed every single one. Support peaks at 83 percent for low-interest loans for students at public colleges and universities, 78 percent for government price controls on higher education costs, and 72 percent for automatic student debt forbearance for the unemployed. Backing for these fixes was lopsided among every generation, family type and income and racial group. [] What is more surprising is how many Americans embrace certain correctives that were dismissed as impractical and even socialist during the 2020 election campaign.” Source: “Are Americans Turning ‘Socialist’ About Student Debt?,” by Will Johnson, INSIDE HIGHER ED, January 19, 2021,

Archive-1: https://Archive.vn/oaguW

See also: https://ContractWithAmerica2.com/#polls

{{25}} COLLAPSE OF THE U.S. DOLLAR CERTAIN: This portends a sure and eventual, even if not imminent, collapse of the U.S. Dollar for no less then seven (7) reasons:

[#1.] The CBO (The Congressional Budgeting Office) has said that the U.S. Student-Loan Program has begun losing money (running a deficit), and that was in early May 2019, even before the Covid-19 Economic Downturn: “U.S. Student-Loan Program Now Runs Deficit, CBO Estimates: Cost to taxpayers could reach billions of dollars over a decade, according to a recent estimate,” by Josh Mitchell, The Wall Street Journal, Tue., 07 May 2019, 5:32 pm (EST)

LINK: https://www.wsj.com/articles/u-s-student-loan-program-now-runs-deficit-cbo-estimates-11557264772

Archive-1: https://Archive.vn/CVvDP

To be fair, an "opposing" view is put forth by two higher ed financial experts (Collinge and Reilly, at FORBES) on CBO's use of FVA (Fair Value Accounting), here: “Interview With Student Loan Activist Alan Collinge - Fair Value In An Unfair System ?,” by Peter J. Reilly, Contributor, with guest interviewee, Alan Collinge, Forbes, Thursday, July 11, 2013, 10:16am (EDT), LINK: https://www.Forbes.com/sites/peterjreilly/2013/07/11/interview-with-student-loan-activist-alan-collinge-fair-value-in-an-unfair-system

Archive-1: https://Archive.vn/2288V

Archive-3: https://ContractWithAmerica2.com/AlanCollinge-FairValueAccounting_FORBES_viaWaybackMachine.pdf

For more information: https://ContractWithAmerica2.com/#cbo

However, even if Collinge and Reilly are correct (and they may be), the matter is moot: Any "improvements" seen in their analyses of gov't profits are offset by the losses of students who are crushed to make this happen. The logic here is simple: If the government is doing "better" than the C.B.O. analysis, above, then the "extra" help must come from somewhere -- students are crushed even further; so, while this "helps" the Department of Ed, the humans who are crushed (to make this happen) do NOT have a positive effect on the economy, and thus, it stands to reason, this extra "human pain" speeds -- not slows -- the inevitable and certain crash of the dollar. But this strong claim is proved here with all these overwhelming facts & documented sources.

[#2.] As reported elsewhere, former Sec. of Education, Betsy DeVos, called out the Dept of Ed for its profligate and reckless spending in her 11-27-2018 speech: “Today, FSA's [student debt] portfolio is nearly 10 percent of our nation's debt. [] Stop and absorb that for a moment. Ten percent of our total national debt.” Source: U.S. Dept of Education, Sec. of Education, Betsy DeVos, 11-27-2018 speech, LINK-1: https://Archive.vn/aRKbd

LINK-3: https://ContractWithAmerica2.com/DeVos-speech_11-27-2018_PDF.pdf

DeVos was obviously copying (without giving attribution or credit) a prior statement, made eleven (11) days earlier, in a published column by Register editor, Gordon Watts: “My prior column documented [former congressman, Dennis] Ross’ promise to not only support bankruptcy equality for collegiate loans, but also opposition for use of tax dollars to make or guarantee said loans. But he never introduced legislation for either. Where has that gotten us? [] Collegiate debt, now almost $2 trillion, is almost 10 percent of total U.S. debt. I predict we will crash the U.S. dollar if we ignore “crazy Gordon” one more time.” Source: “Polk Perspective: Rescue taxpayers from mounting student debt,” By Gordon Wayne Watts, Guest columnist, The Ledger, November 16, 2018, LINK: https://www.TheLedger.com/opinion/20181116/polk-perspective-rescue-taxpayers-from-mounting-student-debt

Archive-1: https://Archive.is/YrNST

[#3.] The looming "Debt Ceiling" crisis: "If the US defaults on debt, expect the dollar to fall – and with it, Americans’ standard of living," by staff at THE CONVERSATION, October 11, 2021, 8.17am, EDT,

LINK: https://TheConversation.com/if-the-us-defaults-on-debt-expect-the-dollar-to-fall-and-with-it-americans-standard-of-living-169079 Archive-1: https://Archive.vn/h6aoI

Archive-2: https://Web.Archive.org/web/20211012172446/https://theconversation.com/if-the-us-defaults-on-debt-expect-the-dollar-to-fall-and-with-it-americans-standard-of-living-169079 ; "U.S. faces a recession if Congress doesn't address the debt limit within 2 weeks, Yellen says," by Thomas Franck, CNBC, Pub. Tue. Oct. 5, 2021, 7:40 AM (EDT), Updated Tue. Oct. 5, 2021, 2:38 PM (EDT), LINK: https://www.cnbc.com/2021/10/05/debt-ceiling-us-faces-recession-if-congress-doesnt-act.html

Archive-1: https://Archive.vn/qb49s Archive-2: https://Web.Archive.org/web/20211013031955/https://www.cnbc.com/2021/10/05/debt-ceiling-us-faces-recession-if-congress-doesnt-act.html

[#4.] Many Bible commentators believe that Bible, with its surprisingly accurate predictions in Ezekiel 37:21-22 and Isaiah 66:7-8 that Israel would become a nation after an approximately 2,000-year absence, also predicts hyper-inflation and/or famine in Revelation 6:6, which says that a whole day's wages (denarius or "penny" in KJV) would be needed for a day's ration of food ("quart of wheat"), LINK: https://www.BibleGateway.com/passage/?search=Revelation%206%3A6&version=AMP

Archive-1: https://Archive.vn/4Cv68

NOTE: While, normally, this "proof" of potential hyperinflation or a collapse of the dollar would be restricted to "opinion" or "religion" pieces, nonetheless, The Bible is given credence for its many accurate predictions. One example: Ezekiel 37:21-22 predicts that Israel will be re-gathered & reborn as a nation -and Isaiah 66:7-8 goes on to add that Israel will need only one day to be reborn. However, never in the history of the world had such a thing happened before. But, as predicted and foretold, Israel became a recognised nation, and "born in one day," as predicted. After being away from their homeland for almost 2,000 years, the Jewish People were given a national homeland in Palestine by the Balfour Declaration in November, 1917. In 1922, the League of Nations gave Great Britain the mandate over Palestine. On May 14, 1948, Great Britain withdrew her mandate, and immediately Israel was declared a sovereign state, and her growth and importance among nations became astonishing -- thus adding credibility to the hyperinflation, famine, and economic collapse predictions. Sources:

STATE dot GOV – https://History.State.gov/milestones/1945-1952/creation-israel

BRITANNICA – https://www.Britannica.com/event/Balfour-Declaration

HISTORY dot COM – https://www.History.com/topics/middle-east/balfour-declaration

Yes, even Wikipedia – https://en.Wikipedia.org/wiki/Balfour_Declaration

[#5.] Navient becomes the fourth (4th) major student loan servicer to announce an abrupt exist from the U.S. Department of Education's troubled and tumultuous student loan system, a hot potato item that major banks don't even want to touch in a "servicing" capacity, much less a lending capacity. – Source: * BREAKING: Fourth (4th) Major student loan servicer quits: Crash of the U.S. Dollar eventual, if not imminent (Wed.13 Oct. 2021), The Register:

Mirror-1: https://GordonWatts.com/#crash

Mirror-2: https://GordonWayneWatts.com/#crash

Archive-1: https://Archive.vn/v3jgo#crash

Archive-2: https://Web.Archive.org/web/20211220182734/https://gordonwatts.com/#crash

[#6.] The COVID-19 Pandemic economic downturn has not only taken a devastating toll world-wide, but moreover, due to recent controversies surrounding vaccine "mandates," many industries are disrupted, experiencing wide-spread "walkouts" and "sickouts," not to mention the overflow experienced by some hospitals which were overrun by COVID patients -- thus directly and indirectly affecting the supply chain and making daily deliveries of many commodities uncertain.

[#7.] Grid, weather, emerging solar flare threats, the slow-but-sure collapse of earth's protective magnetic field, pollution, environment, and exponentially-increasing population densities, foreign wars and unrest, and potential EMP attacks, hacking & cybersecurity threats, and such,

LINK: https://ContractWithAmerica2.com/#grid

Mirror-1: https://GordonWatts.com/n.index.html#grid

Mirror-2: https://GordonWayneWatts.com/n.index.html#grid

Archive-1: https://Archive.vn/5xX2Q#grid

Archive-2: https://Web.Archive.org/web/20211209115917/http://contractwithamerica2.com/#grid

Thus, lawmakers must file some version of the loan limits (pork spending cuts) bill, shown in APPENDIX-A of the written testimony which Register editor, Gordon Watts, recently submitted to the U.S. Senate Judiciary Committee, as reported on above—and that only becomes politically possible with the “threat of bankruptcy” returned back into the hands of students, so these 2 bankruptcy bills become critical to the saving of the nation.

{{26}} PROOF THAT REMOVAL OF BANKRUPTCY WAS NOT JUSTIFIED BY BANKRUPTCY ABUSE: Back when student loans were treated the same as all other loans in bankruptcy court, only about zero-point-three (0.3%) percent were discharged in bankruptcy: Back when student loans were treated the same as all other loans in bankruptcy court, only about zero-point-three (0.3%) percent were discharged in bankruptcy. (Because college was affordable, remember? No one even NEEDED a "student loan," much less one subsidised by our tax dollars, thus bankruptcy abuse did not occur. But when Liberals made "student loans" available on the tax dollars, colleges jacked up tuition to match increased borrowing abilities, creating a Higher Education Bubble -- which WILL burst if we don't stop insane spending of tax$$ on making/backing college loans.) PROOF: "By 1977 only .3% of student loans had been discharged in bankruptcy." Source: "The History of Student Loans and Bankruptcy Discharge," by Steven Palmer, Partner at Curtis, Casteel & Palmer, PLLC, LinkdIn, Published Oct 1, 2015,

LINK: https://www.LinkedIn.com/pulse/history-student-loans-bankruptcy-discharge-steven-palmer

Archive-1: https://Archive.vn/AKgJI

*** MOREOVER: "Debunking the first premise is the fact that by 1977, under 0.3% of the value of all federally guaranteed student loans had been discharged in bankruptcy...(See H.R. REP. NO. 95-595, at 148 (1977).)" Source: "ENDING STUDENT LOAN EXCEPTIONALISM: THE CASE FOR RISK-BASED PRICING AND DISCHARGEABILITY," 126 Harv. L. Rev. 587, HARDARD LAW REVIEW, quote from p.607, Dec. 20, 2012,

LINK: http://HarvardLawReview.org/wp-content/uploads/pdfs/vol126_student_loan_exceptionalism.pdf (PDF format)

Archive-1: https://Archive.vn/r63Ln

Archive-3: https://ContractWithAmerica2.com/vol126_student_loan_exceptionalism.pdf

LINK: https://HarvardLawReview.org/2012/12/ending-student-loan-exceptionalism-the-case-for-risk-based-pricing-and-dischargeability (HTML webpage format)

Archive-1: https://Archive.vn/pkPL3

Archive-3: https://ContractWithAmerica2.com/EndingStudentLoanExceptionalism_HLR_PDF.pdf (PDF format of webpage article) Thus, there was no abuse by students seeking bankruptcy, and thus removal was not justified. In fact, removal of bankruptcy defense (aka the Economic Second Amendment) made students defenseless, and thus *increased* price-gouging and abuses that were not present before. For example, credit card companies don't loan insane amounts because borrowers have bankruptcy defense. Thus, bankruptcy defense must be restored to avert and prevent a crash of the dollar, which is threatened with this insane lending using our tax dollars.

{{27}} Source: “Government projects to make $50B in student loan profit,” by David Jesse (via the Detroit Free Press), USA Today, Published 3:03 a.m. ET June 16, 2013 Updated 8:37 a.m. ET June 16, 2013, LINK: https://www.UsaToday.com/story/news/2013/06/16/us-government-projected-to-make-record-50b-in-student-loan-profit/2427443

Archive-1: https://Archive.vn/tQBWr

Archive-3: https://GordonWatts.com/GovtProjects50B-dollar-StudentLoanProfit_viaArchiveToday.pdf

Archive-4: https://GordonWayneWatts.com/GovtProjects50B-dollar-StudentLoanProfit_viaArchiveToday.pdf

Archive-5: https://ContractWithAmerica2.com/GovtProjects50B-dollar-StudentLoanProfit_viaArchiveToday.pdf

CONCLUSION

THEREFORE: Please pass both bankruptcy bills (S.2598 & H.R.4907) into law, & then, with the “threat of bankruptcy” to make higher ed swamp back off, get Liberal pork student loan bailout subsidies / spending GONE, & enact “Conservative” Rule of Law price controls in higher ed!!

If that looks daunting, just pick a few favourite points above & MAKE THE CALL—& repeat til it's passed.

Author: Gordon Wayne Watts ; Last Updated: Tuesday, 11 January 2022

E-mail: Gww1210@Gmail.com, or Gww1210@AOL.com

Work: (863) 687-6141 ; Direct: (863) 688-9880

GoDaddy Mirror, The Register: https://GordonWatts.com

Archive-1 snapshot: https://Archive.vn/h3mJJ

Archive-1 library: https://Archive.vn/gordonwatts.com

Archive-2 snapshot: https://Web.Archive.org/web/20220111215733/https://gordonwatts.com/

Archive-2 library: https://Web.Archive.org/web/*/https://gordonwatts.com

HostGator Mirror, The Register: https://GordonWayneWatts.com

Archive-1 snapshot: https://Archive.vn/P1ZeD

Archive-1 library: https://Archive.vn/gordonwaynewatts.com

Archive-2 snapshot: https://Web.Archive.org/web/20220111215806/https://gordonwaynewatts.com/

Archive-2 library: https://Web.Archive.org/web/*/https://gordonwaynewatts.com

Flagship Mirror, CONTRACT WITH AMERICA: PART II(TM), https://ContractWithAmerica2.com

Archive-1 snapshot: https://Archive.vn/BYgT2

Archive-1 library: https://Archive.vn/contractwithamerica2.com

Archive-2 snapshot: https://Web.Archive.org/web/20220107193323/https://contractwithamerica2.com/

Archive-2 library: http://Web.Archive.org/web/*/https://ContractWithAmerica2.com

SOCIAL:

Facebook: https://Facebook.com/GordonWayneWatts

Twitter: https://Twitter.com/Gordon_W_Watts

Instagram: https://www.Instagram.com/BobbyWattsSpeedShop

YouTube: https://YouTube.com/GordonWayneWatts

LinkedIn: https://www.LinkedIn.com/in/Gordon-Wayne-Watts-533662209

QUESTION: Why all the extra archives and mirrors?

ANSWER: In case the GRID goes down & we have a “flat tire” on

the Internet Highway... Here's a spare! – https://ContractWithAmerica2.com/#grid